On March 24th the New York Times published an article called “ Social

Security Payouts to Exceed Revenue,” a title that isn’t entirely accurate.

If you count as revenue the interest earned on the $2.5 trillion trust fund,

Social Security is still in the black. However, if you compare benefit payments

to the revenue raised from payroll taxes, Social Security is scheduled to start

running in the red. This was not supposed to happen until 2016.

Financial advisors who talk to clients about Social Security today may feel

like they’re on the firing line. Some people have deep-seated fears that Social

Security will be gone before they ever get to it. Others use Social Security as

a scapegoat for their anger over government spending and entitlement programs in

general. To hear the media tell it, Social Security is no longer the safety net

that helps your grandmother pay her bills. Rather, it’s turning into a political

hot potato and a symbol for a lot of things that are wrong with our

government.

When responding to these concerns in your seminars and client meetings, try

to keep the discussion factual and non-emotional. You are there to help clients

understand Social Security as it relates to their own personal financial plan,

not solve the Social Security financing problem. Naturally, if clients balk at

Social Security planning because of their worries about the system, you will

need to address their concerns. But rather than engaging in general speculation,

take a few moments to review the facts about Social Security financing and

gently guide them back to the purpose of your meeting: to understand Social

Security and integrate it into their financial plan as an important—but by no

means only—source of retirement income.

Economy has taken its toll

Three conditions have contributed to a worsening of Social Security’s

finances: (1) higher benefits caused by last year’s generous 5.8% COLA, (2) an

unexpected increase in benefit payments as many unemployed people have taken

Social Security disability or retirement benefits earlier than planned, and (3)

a decrease in payroll taxes as a result of the recession and higher

unemployment.

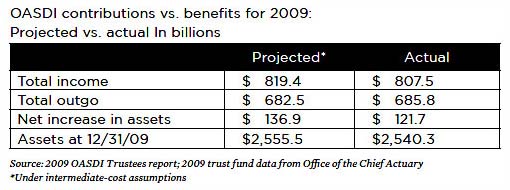

It should be noted that for calendar year 2009, the Social Security (OASI)

and Disability (DI) trust funds ended up in the black. A total of $807 billion

was taken in, and $685 billion was paid out. This added $121 billion to the

combined trust funds, bringing them to a total of $2.5 trillion. This was only

slightly worse than the trustees’ original projections under their

intermediate-cost scenario, which called for total income of $819 billion and

total payments of $682 billion.

|

What has some people concerned—notably Allen Sloan who wrote about it in

Fortune (see “Next in Line for a Bailout: Social Security” at Fortune.com)—is that if you don’t count the interest

earned on the special-issue Treasury securities held by the trust funds, Social

Security has already gone negative.

Of the $807 billion in income received by the combined OASDI trust funds in

calendar year 2009, $667 billion was from payroll taxes. This was $8 billion

less than the $675 billion paid out in benefits. The fund ended up in the black

because it also received $118 billion in interest and $22 billion in income

taxes on benefits. The alarmists say this means Social Security is not

sustainable.The actuaries and accountants say it just means that Social Security

had to dip into interest income temporarily because of the recession.

What about 2016?

You’ve been telling your clients and seminar attendees that based on the

latest Trustees’ report, payroll taxes will be sufficient to pay promised

benefits until 2016, at which time the system will have to start drawing upon

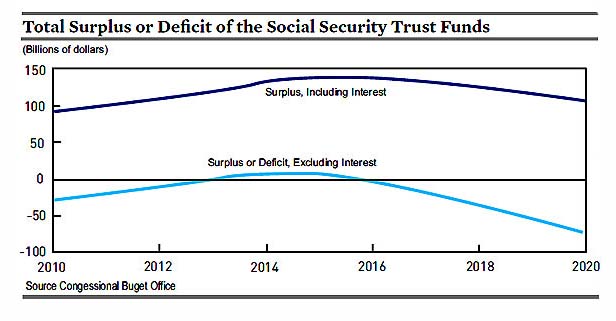

the interest. Does this still hold true given 2009 results? According to the

Congressional Budget Office, this deficit is a temporary result of the

recession. Annual operations will return to a surplus in 2013 before turning

negative again in 2016. If you’d like to add this distinction to your seminar

script, feel free to do so. Otherwise, you can still accurately say that the

Social Security trust funds will not need to draw upon interest to pay benefits

on a permanent basis until 2016. When the 2010 Trustees report comes out in May,

we’ll know if this date has changed.

|

There’s one other distinction you may want to help your clients understand.

It is only because of the strength of the OASI system that the combined OASDI

trust funds remain in the black. Under the high-cost scenario, the DI trust fund

becomes exhausted in 2016. The trustees’ projections assume that funds from OASI

can be used to pay DI benefits, but in reality this cannot occur without

legislation permitting it. So it’s conceivable that if Congress continues to sit

on its hands, Social Security disability benefits could stop while retirement

benefits continue. This is noted on page 40 (page 48 of the PDF) of the 2009

Trustees report, available on the Social Security website. To view financial

operations for any selected time period, use this tool at the Social Security

website.

Reform is coming…someday

Everyone acknowledges that the Social Security system must be reformed. As it

stands now, the math doesn’t work. What has people worried is the uncertainty

surrounding reform. Will the system be abolished, as Paul Ryan (R-WI) has

proposed for those 55 and under? Or will it simply be tweaked in a way that ends

up being relatively painless for everyone?

It should be noted that although the Social Security abolitionists are

getting lots of media play, most Americans favor strengthening the system. A

survey by the National Association of Social Insurance found that two out of

three Americans (66%) favored strengthening the system over cutting benefits.

After all, the same conditions that contributed to worsening Social Security

finances have also contributed to worsening personal finances. Higher

unemployment, higher health care costs, and lack of personal savings mean the

Social Security safety net is needed now more than ever.

Focus on financial planning

In the end, we can’t do much about Social Security’s finances other than to

write our legislators. The only reason to address the issue at all is in the

context of personal financial planning. Ask clients how their understanding of

Social Security financing might affect their decision-making. Does it make them

want to take early benefits so they can grab what they can now? If so, remind

them that they are taking a risk that they will be stuck with a lower benefit

for life. If they are counting on the do-over option to have their cake and eat

it too, there is a good chance that loophole could be closed.

If the trust fund information you give them wouldn’t change their Social

Security decision-making in any way, return your focus to financial and

retirement planning. Help clients maximize their benefits based on the rules as

they exist today and move the discussion toward the much larger issue of how to

supplement their Social Security income with sound investment

programs.