By now almost everyone has heard of the strategy to delay the claiming of one’s Social Security benefits. Why delay? Because you will receive a higher monthly benefit if you wait. In fact, delayed claiming of Social Security benefits until age 70 could mean a payout that is 32% more than you would have received had you started receiving benefits at full retirement age and a 100% more had you claimed your benefits as early as age 62.

The fact is that there are many issues to consider and evaluate before making the decision as to when to claim your Social Security benefits, this very important and for the most part PERMANENT decision. Let’s break-down the issues:

Issue #1 – Giving Up Real Benefits Today in Exchange for The Possibility of More in The Future – If you delay receiving your Social Security benefits, you will not receive any benefit payouts until you claim them. This is obvious, and the obvious counter-issue is that you will also likely have less years to receive benefits as well. For many this becomes a simple break-even calculation. That is, if we receive payments of $1,000 a month for 4 years (Ages 66-70), then we would be giving up $48,000 of income. If we receive a 32% increase at age 70, then our payment would be $1,320 instead. $48,000/$320 month = 150 months or 12.5 years to break even. That said, if you were to live and collect benefits for another 12.5 years you would collect an additional $48,000 of benefits!

Issue #2 – Survivor Benefits – Although know one knows for certain how long one will live, if you are a male married to a female, you can generally assume that the female spouse will outlive her male partner. If the male is older than the female, the odd increase. When one spouse passes, the deceased spouse’s Social Security benefit is terminated. However, Social Security benefit provides the surviving spouse with a continuing benefit. If the deceased spouses benefit was higher than the benefit the survivor had been receiving, then the surviving spouse’s benefit would be increased to that amount. Considering the survivor benefit, therefore is the #1 most important reason that many will make the decision to delay claiming Social Security benefits.

Issue #3 – Taxes – For most people, 85% of the Social Security benefits they receive will be included in their annual income tax calculation. As of this writing, March 4, 2014, the highest marginal Federal income tax rate is 39.6%. If one resides in a high income taxed State like California, add to that another 12.3-13.3% which means that that income would be potentially subject to 52.9% of income taxes.

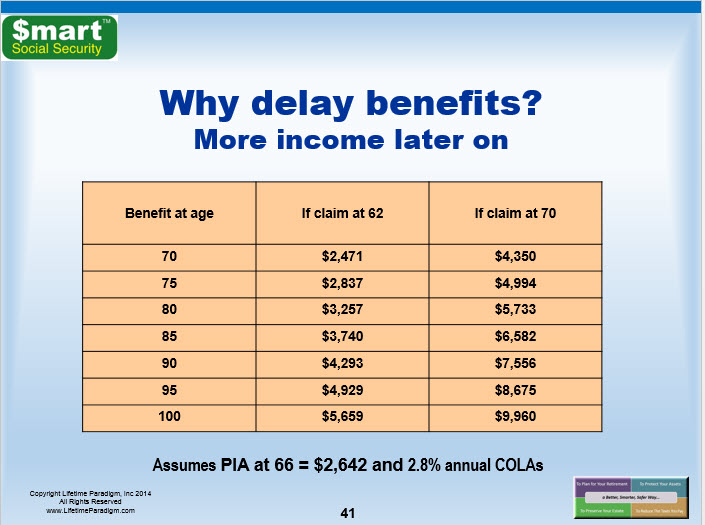

Issue #4 – COLA’s (Cost of Living Adjustments) – Social Security benefits can increase from year-to-year whenever the Government reports an increase to the cost of living. Over the years these COLA adjustments have been substantial at times, reaching as high as 14.3% in 1980. In general most Advisors will use a 2.8% average, however, when illustrating the payment increases associated with these COLA adjustments. Just look at the effect delaying claiming when combined with COLA adjustments can have on your Social Security payments in the graphic below.

Assuming a Social Security benefit, or Primary Insurance Amount (known as PIA) of $2,642 at Full Retirement Age (known as FRA), one could start to receive benefits as early as age 62. Benefits taken at 62 are reduced by 25%. Therefore, assuming a 2.8% annual COLA increase by age 70 that reduce monthly benefit would have grown to $2,471. The COLA adjustment has made up for the 25% reduction for early claiming. However, had you waited until you were 70 to start receiving benefits the monthly payment would be $4,350 almost twice as much. Furthermore, that reduction in payment never goes away so at any age you will continue to receive a lower payment. By age 100 the difference is quite remarkable.

In Summary – Delaying claiming your Social Security benefits can make a dramatic impact on the amount of total benefits one “might” receive over one’s lifetime. Of course no one knows for certain how long that may be. That is why it is important to make your decision to claim Social Security benefits as soon as possible, to or wait as long as possible, needs to be made in the context of an overall financial strategy that considers your health, your other sources of retirement income as well as those of your spouse. Taking a comprehensive approach is the ONLY smart thing to do. Finally, keep in mind that once you have made the decision that there is little you can do to change things. We will deal with this issue/opportunity in another post.

If you would like to learn what the best choice for you and your situation might be, click on this link. This will direct you to www.SmartSocialSecurity.com Here you have the opportunity to learn more about our proprietary programs, “The $mart Social Security Benefits Maximizer” and “The Retirement Healthcare Expense Estimator“. You will also will find a couple educational videos, a lengthy and detailed audio recording describing the benefits of this program and, if you are not ready to enroll, you can try our FREE benefits strategies estimator right there on-line (completely Free and extremely insightful).

It’s a Good Life!

Randall A. Luebke RMA, RFC